CIBC Drives ML-Powered Quant Analytics with Plotly Dash Enterprise and Databricks

Industry

Financial Services

Integration

Databricks

Infrastructure

Azure

Summary

- Dash Enterprise empowers technical users in business-focused roles to express creativity by building innovative and professional data apps with ease.

- With Dash Enterprise, the Quantitative Solutions group is able to quickly develop and deploy custom interactive analytics applications with insights from machine learning models.

- Quantitative Solutions has realized indirect cost savings and increased independence by enabling quant analysts to rapidly develop and iterate on data applications through to production.

- Sales and Trading desk associates are able to engage with the interactive models, gaining a deeper understanding of markets and their clients, to better serve CIBC’s customer base.

Introduction

The Canadian Imperial Bank of Commerce (CIBC) is a multinational banking and financial services corporation headquartered in Toronto, Canada.

As a key business unit of the bank, CIBC Capital Markets offers equity and debt capital market products, mergers and acquisitions, global markets (sales and trading), merchant banking, and other investment banking advisory services. Within Capital Markets’ sales and trading business, the Quantitative Solutions group develops the derivatives pricing library used by the bank to price and manage risk surrounding its derivatives portfolios. The group also supports trading and sales desks in market and position analysis with the development of machine learning models and other data science initiatives.

Dash Enterprise is used by the Quantitative Solutions group — spread across London, New York, and Toronto — for delivering quantitative analytics and data science. Additionally, the platform is utilized by the Technology group to build personalized, ad-hoc tools and is also accessed by sales and trading as part of a self-service analytics offering.

Note: Jeff Butler, Executive Director - XVA Trading at CIBC, was recently featured in a Plotly Hangout. Check out his recap blog on data science's impact on portfolio management in finance.

Challenge

The Quantitative Solutions group at CIBC Capital Markets needed a way to reduce friction and time-to-insight when communicating and actioning against insights in response to rapidly changing market conditions. The team aimed to enable ad-hoc departmental level client analytics for individual trading and sales desks, while simultaneously developing operationalized data applications for deeper actionable insights across broader groups.

These projects were traditionally handled in spreadsheets which, while highly effective for exploratory and small-to-mid sized projects, halted progress due to their static nature. The team experimented with BI solutions, but found these platforms too difficult to customize and develop to their specific requirements.

The Quantitative Solutions group was looking for a solution that would enable its quantitative analysts and data scientists to rapidly build ad-hoc custom visuals through to larger-scale analytics applications with production-grade user interfaces via a common platform.

Solution

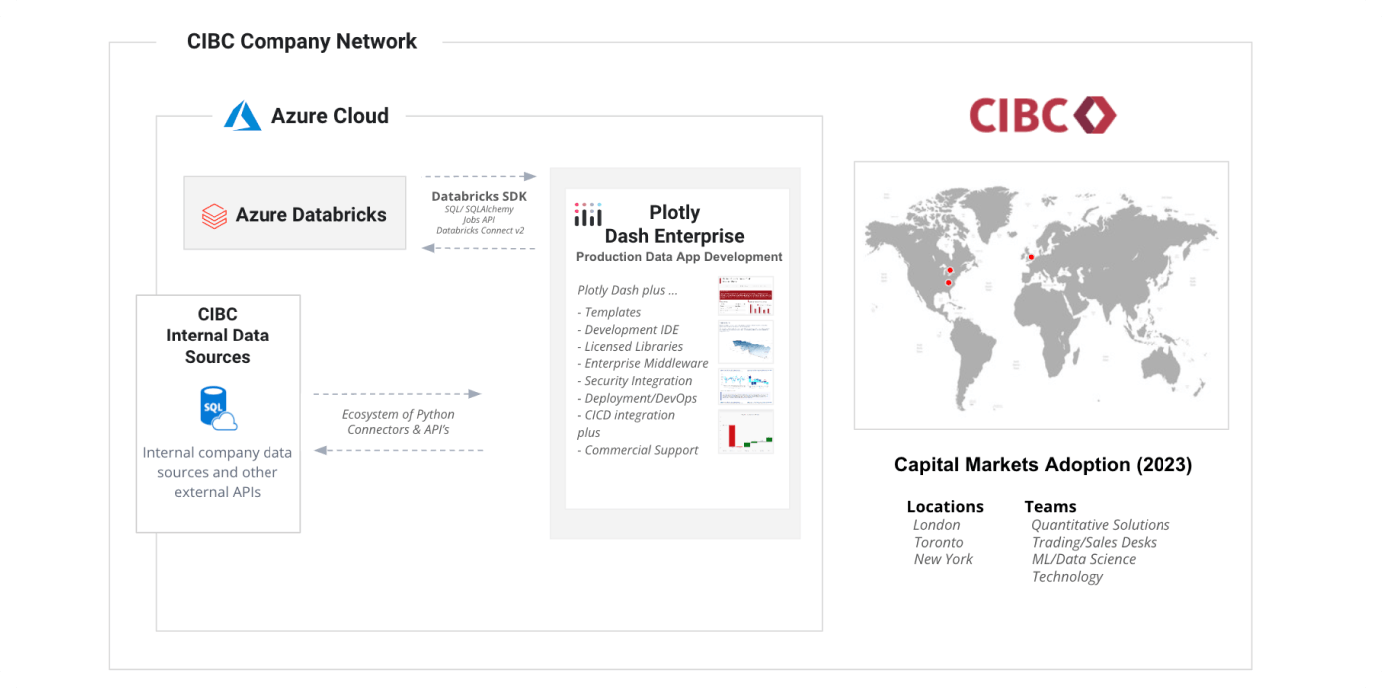

With Dash Enterprise, the Quantitative Solutions group is able to regularly develop and deploy custom client analytics applications with insights from machine learning models. These data applications largely utilize Databricks as their primary data platform, but the apps can also be powered by other internal data sources and APIs. They are then deployed as production-grade data applications through Dash Enterprise and accessed from within the CIBC intranet.

“Dash has been a valuable outlet to make the best use of people’s skills and creativity. It allows people to very quickly turn an idea into a useful tool that can be used by the rest of the team.”

Gareth Stoyle, CIBC

CIBC's data application architecture

The apps enforce strict security measures with custom internal security and authentication integration to protect access to data and channel information toward the appropriate audiences. This tightened security is achieved while preserving the self-service nature of client analytics apps for sales and trading desks.

Results

Dash Enterprise has significantly increased the volume of insightful applications developed and deployed by the Quantitative Solutions team. This in turn has led to faster access to a wider range of actionable insights for the CIBC Capital Markets group as a whole, and has resulted in adoption by multiple teams in multiple jurisdictions.

- Quantitative Solutions realized indirect cost savings and reduced dependence on IT by enabling quant analysts to develop production-grade apps.

- The Technology team saved time by automating small, custom, and ad-hoc applications that would otherwise require longer development time.

- CIBC Capital Markets unlocked the art of the possible, increasing their ability to craft creative solutions that can be seen through to the production environment providing real value.

- Sales and Trading desk associates were able to develop a deeper understanding of their clients, to better serve CIBC’s customer base.

About CIBC

CIBC is a leading and well-diversified North American financial institution committed to creating enduring value for our clients, team, communities and shareholders as we activate our resources to create positive change and contribute to a more secure, equitable and sustainable future. For more information please see https://www.cibc.com/en/about-cibc.html.