Scaling Quantitative Analytics at a Global Financial Services Institution with Python and Dash

Industry

Finance

Infrastructure

GCP

Summary

- The Portfolio Analytics team at a leading financial institution leveraged the extensible, open-core design of Dash Enterprise to build custom APIs that lower the barrier for 600 financial analysts to build and share their own analytics assets within corporate standards.

- Using Dash Enterprise, the team experienced development times up to five times faster than their previous work in C#, removing the need for IT involvement and giving them more time to focus on model development.

- Lengthy multi-team processes consolidate into a single Dash app that runs predictive models, automates reporting, and enables interactive client involvement.

Introduction

The Portfolio Analytics team at one of the world’s largest banking and financial services groups, serving over 40 million global customers, creates and manages digital tools for internal business groups in the United States, Asia, and Europe. Using Dash Enterprise and Python, they built an analytics platform and several custom APIs to facilitate and standardize analytic app development across the organization.

“Without Dash, we cannot be autonomous in the business of web application development. Dash simplifies security and deployment, so we can focus on developing quantitative and predictive models.”

Head of Portfolio Analytics at the financial services firm

Challenge

Success in the financial services sector relies heavily on the speed with which service providers can process data. To remain competitive, the company needed to leverage an ecosystem spanning artificial intelligence, coding, and automation. However, reconciling business-focused groups and the much smaller Portfolio Analytics team with this highly technical environment presented problems in multiple areas:

- Portfolio management: Portfolio managers required a system to collect and centralize analytics from 600 financial analysts who are familiar with Excel and VBA code, but are not traditional developers. The Portfolio Analytics team was tasked with developing the system, but working in C# meant deploying a single analytics app requiring coordination across multiple database teams and IT. This resulted in 2-week lead times to deploy a single app — not a scalable process to complete the mandate.

- Automated client reporting: Several teams are involved in the key business process of helping clients select the best investment options, from the strategist who interfaces with the client and the product specialists and data managers behind the scenes to the Marketing and Sales teams that package and present the tailored products. This process combines quantitative analysis and artificial intelligence to generate the optimal results for a client’s scenario. However, it is time- and resource-intensive, with many skill sets and stakeholders involved.

Solution

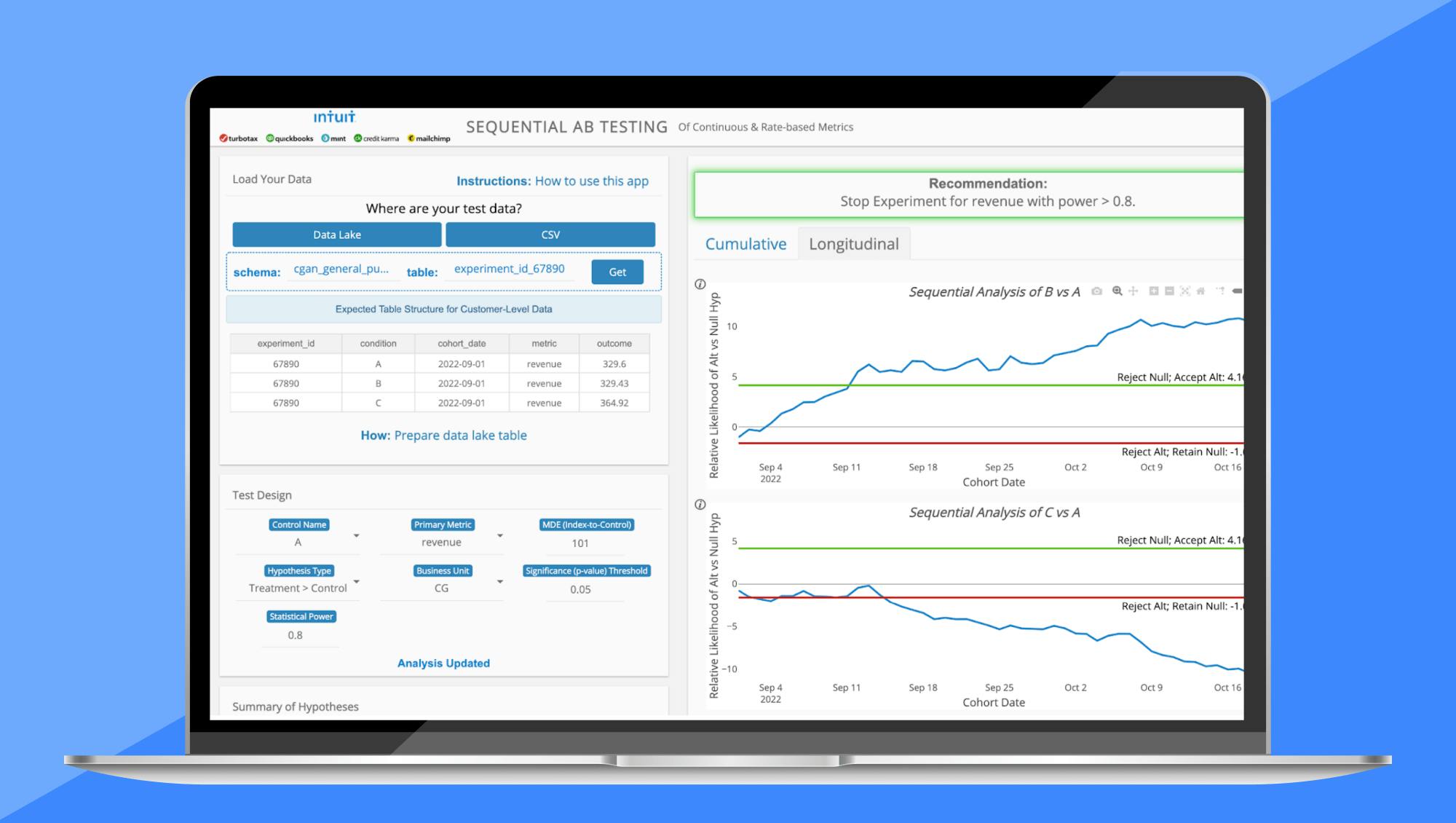

Portfolio management apps: By switching to Dash Enterprise and Python, the Portfolio Analytics team could build and deploy analytic apps much faster, without IT support. To scale further and enable the 600 financial analysts to build analytics deliverables themselves, the team leveraged the extensible, open-core nature of Dash Enterprise to develop internal APIs. These APIs lowered the barrier for non-developer analysts to create their own custom yet standardized analytics tools. The APIs integrated with internal IT and communications systems, ensuring Dash Enterprise was not simply a parallel ecosystem within the organization.

Liability and Analysis app: The Dash-powered app made the client conversation an interactive process. With the client’s input, the strategist can enter risk tolerance and other parameters directly via the app’s user interface. Quantitative models and predictive artificial intelligence on the back end simulate results under various regulatory conditions, which become immediately available for exploration as data visualizations. Branded marketing assets can be automatically generated from the Dash app itself, ready for the Sales team to share as PDFs and emails.

Results

Using Dash Enterprise, the Portfolio Analytics team experienced development times up to five times faster than their previous work in C#. By choosing to develop applications using Dash Enterprise and Python, the team now deploys apps in three days instead of two weeks. Additionally, because Dash apps are much lighter than the legacy C# applications, the Portfolio Analytics team no longer needs to coordinate with the IT team before deployment.

“C# is not a data science language, and a C# optimizer requires a license fee. With Dash, we can leverage the community of data scientists, and the Python optimizer is open-source and free.” - Head of Portfolio Analytics at the financial services firm.

The Liability and Analysis app reduced a week-long, 3-team process and consolidated the workflow into an interactive application. Powerful quantitative analytics and artificial intelligence are abstracted away behind rich data visualizations that clients and strategists can explore together. Dash Enterprise’s Snapshot Engine helped automate the reporting processes, equipping the Sales team with ready-to-use branded assets.

Additionally, by putting Python and Dash Enterprise at the core of its analytics operations, the organization has become more competitive in a labor market where the majority of quantitative analytics candidates are taught Python at university.

About Plotly

Plotly is a software company whose mission is to enable every company, around the world, to build data apps. Our product, Dash Enterprise, is a platform of best-in-class development tools to quickly and easily visualize data in Python from virtually any data source. With customers across the Fortune 500, Plotly is a category-defining leader in enabling data-driven decisions from advanced analytics, machine learning, and artificial intelligence.